Learn more about the reverse mortgage loan, offered by Primary Residential Mortgage, Inc.

Jump to a section: Basics | Benefits | Timeline | Types: Refinance or Purchase | Get Started | About Lincoln

Reverse Mortgage Basics

A reverse mortgage is a home loan available to seniors who are 62 years and older. A reverse mortgage allows you to convert the equity you already have in your home into cash proceeds that can be used to eliminate an existing mortgage with required payments or to provide additional cash or monthly income. A reverse mortgage can also help you purchase a new home above the down payment you have available without requiring monthly mortgage payments. For many seniors, a reverse mortgage is a very useful tool in retirement and investment planning, supplementing both your income and liquid assets while preventing the depletion of your already saved or invested funds.

The amount a homeowner is eligible to receive from a reverse mortgage is different for everyone. The calculation for the loan is based on current interest rates, the loan program selected, the age of the youngest borrower, and the property’s appraised value or purchase price. Our reverse mortgage specialist, Lincoln Chris, can provide specific information about how you qualify for a reverse mortgage and on different ways you can make your home’s equity work for you.

Jump to a section: Basics | Benefits | Timeline | Types: Refinance or Purchase | Get Started | About Lincoln

Benefits

Tax-free Proceeds: Any money you get from a reverse mortgage can be used however you want, and you won’t ever be taxed on it.

Payout Options: You can receive reverse mortgage funds as a lump sum, a lifetime monthly payment, or a line of credit that grows over time. You can also choose a combination of these payment options.

Retirement Security: If you need to supplement your income, your home’s equity may be able to give you the money you need. A reverse mortgage is a retirement tool that gives you the freedom to use your retirement savings and investments in the way that is best for you.

Home Ownership Doesn’t Change: With a reverse mortgage, you will continue to live in and retain ownership of your home. Since ownership doesn’t change, you can still leave the home to your heirs.

Non-recourse Loan: FHA reverse mortgages are non-recourse loans. This means that if the loan exceeds your home’s value, neither you nor your heirs will ever pay more than the home is worth. Additionally, neither your assets nor those of your family are collateral for the loan.

No Payments: There are never any mortgage payments with a reverse mortgage. The loan balance isn’t due until the last borrower permanently leaves the home.

Jump to a section: Basics | Benefits | Timeline | Types: Refinance or Purchase | Get Started | About Lincoln

Timeline to a Reverse Mortgage

1. An Independent Counseling Session

Traditional reverse mortgages (known as HECM loans) are insured by the Federal Housing Administration (FHA). The FHA requires that you take part in an independent counseling session to make sure that a reverse mortgage is a good fit for your needs and that you fully understand the program. This can be done over the phone or face-to-face in about 45 minutes.

2. Qualify and Choose a Loan

The loan amount you qualify for is generally based on your home’s purchase price or appraised value, subject to the HUD (U.S. Department of Housing and Urban Development) limit for your county—whichever is lower. If your home has substantial value and you need a larger reverse mortgage there are programs known as jumbo reverse mortgages which allow you to qualify for a loan above HUD’s limit. These loans have additional restrictions and qualifications and it is best to discuss them with our reverse mortgage specialist if you feel this is something you would need.

3. Complete Repairs and Clear Judgments/Loans

No matter what type of reverse mortgage you get, the home must be your primary residence, and any health and safety related home repairs must be completed before your loan closes. More minor repairs may be able to be completed after closing has taken place. Additionally, any loans, liens, or judgments currently on the home must be paid off first with the proceeds from the reverse mortgage.

4. Keep the Home in Good Condition

Once your reverse mortgage is complete, you must keep the home in good condition as well as keep your property taxes and insurance current.

5. Repay the Loan

When the last borrower permanently leaves the home, the amount of the loan is repaid, either by you or your heirs or the home is granted to the bank in lieu of repayment.

Jump to a section: Basics | Benefits | Timeline | Types: Refinance or Purchase | Get Started | About Lincoln

Two Types of Reverse Mortgages

Refinance

You need to have substantial equity in your home to do a reverse mortgage refinance because you’re borrowing against your home’s existing equity. After you pay off any existing mortgages or liens, your proceeds can be taken in a lump sum, as a lifetime monthly payment, or as a line of credit you can tap when needed. With the line of credit option, your available credit actually grows each month you have not used it. Once the reverse mortgage is complete, you won’t have mortgage payments for the remainder of the time you stay in the home.

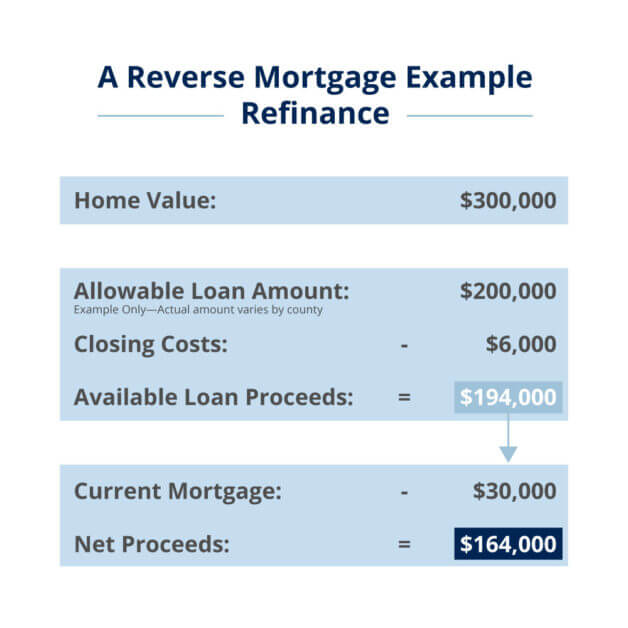

Let’s say that a retired couple wants to increase their monthly income but doesn’t want to take more money out of their retirement account. Their home’s value is currently $300,000, but they still owe $30,000 on their mortgage. Here is a breakdown of the couple’s reverse mortgage proceeds:

*Example only—actual amount varies by county and individual qualifications.

*Example only—actual amount varies by county and individual qualifications.

Jump to a section: Basics | Benefits | Timeline | Types: Refinance or Purchase | Get Started | About Lincoln

Purchase

If you want to move to a new home, a purchase reverse mortgage may work for you. This option allows you to buy a new home at a purchase price above your available down payment without having to make mortgage payments. You must have a significant down payment for a reverse mortgage purchase. Generally, you will need to put down between 25% and 50% of the new home’s purchase price depending on the youngest borrower’s age.

Funds for the new home may come from the sale of your old home, gift money, your personal savings, or other acceptable sources. These are combined with the reverse mortgage proceeds to make up the full purchase price. Again, the biggest advantage of this type of reverse mortgage is that you will not have a mortgage payment, even when your down payment is less than the home’s price.

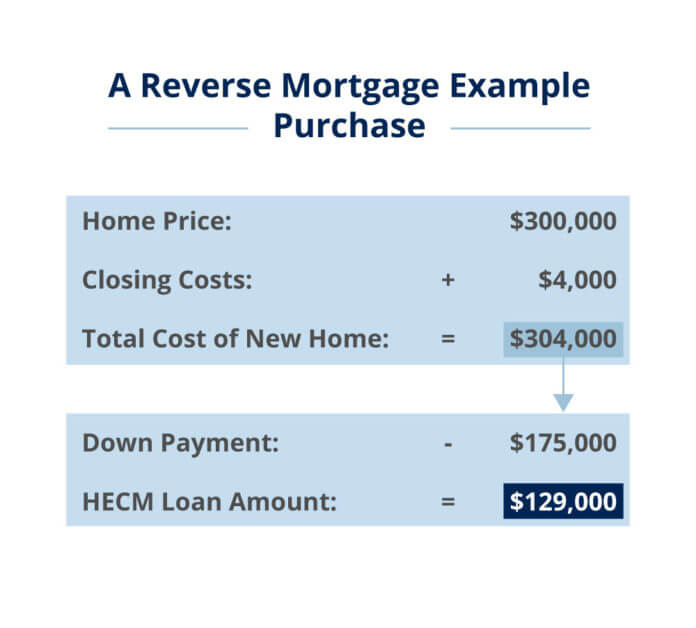

Let’s say that a retired couple would like to sell their old home and purchase a new home. The home they would like to buy is valued at $300,000. They received $175,000 from the sale of their old home. They want to use a reverse mortgage to finance the rest of their new home. Their purchase scenario might look something like this:

*Example only—actual amount varies by county and individual qualifications.

Jump to a section: Basics | Benefits | Timeline | Types: Refinance or Purchase | Get Started | About Lincoln

To Get Started

A reverse mortgage is a powerful loan tool, and its ability is specific to each individual. To get a good idea of how a reverse mortgage might work for you, just give Lincoln a call so you can discuss all your questions and options. Here is the info you’ll need to get started:

- Your property’s estimated value or potential purchase price

- Your mortgage balance (if applicable)

- Your address, including zip code

- The age of the youngest homeowner

Jump to a section: Basics | Benefits | Timeline | Types: Refinance or Purchase | Get Started | About Lincoln

Lincoln Chris Bio

Lincoln Chris is the reverse mortgage specialist with the San Francisco Division of Primary Residential Mortgage. Lincoln has been in the mortgage industry for many years and has a solid financial planning background. He was first trained as a CPA, and he is both a licensed mortgage officer and a former real estate broker. He works closely with industry experts to stay current on all aspects of the reverse mortgage marketplace. He also prides himself on visiting his clients in person, when possible, to make sure that they have a complete understanding of this very secure mortgage product.

Lincoln has lived in the San Francisco Bay area for over 40 years and is a proud graduate of Golden State University. He is an avid gardener, and he enjoys spending his free time with his family.

Jump to a section: Basics | Benefits | Timeline | Types: Refinance or Purchase | Get Started | About Lincoln